Overview of China's Sporting Goods Import and Export Performance in 2025 H1

Source:CHINA SPORTING GOODS FEDERATIONRelease time:2025-09-28Clicks:

According to data released by the General Administration of Customs of the People’s Republic of China, the total value of China’s merchandise imports and exports in the first half of 2025 reached RMB 21.79 trillion, representing a year-on-year (YoY) increase of 2.9%. Of this, exports amounted to RMB 13 trillion (+7.2% YoY), while imports totaled RMB 8.79 trillion (-2.7% YoY).

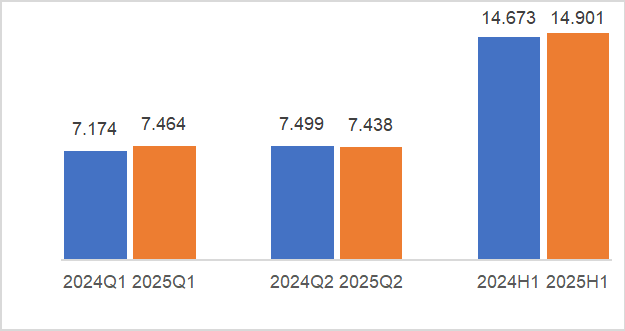

The total import and export value of sporting goods reached USD 15.581 billion,(+1.20% YoY). Exports reached USD 14.901 billion (+1.56% YoY) and imports totaled USD 679 million (-5.91% YoY).

Figure 1. Sporting Goods Exports (USD billion)

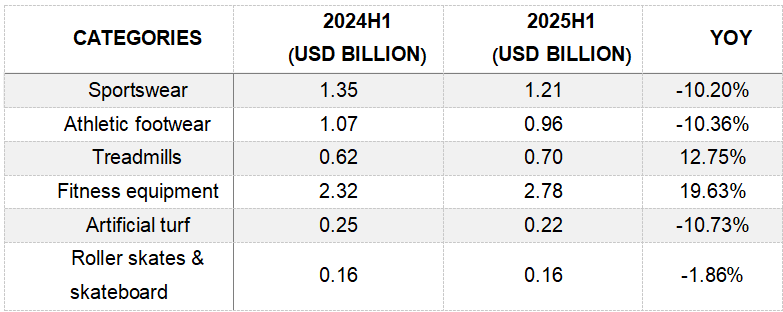

In terms of product categories, fitness equipment and treadmills demonstrated outstanding export performance, with values reaching USD 2.78 billion (+19.63% YoY) and USD 698 million (+12.75% YoY) respectively. In contrast, exports of sportswear, athletic shoes, and artificial turf declined by more than 10%, while roller skates and skateboards saw a decrease of 1.86%.

Table 1. Export Value and Growth Rate of Major Sporting Goods Categories (H1 2025)

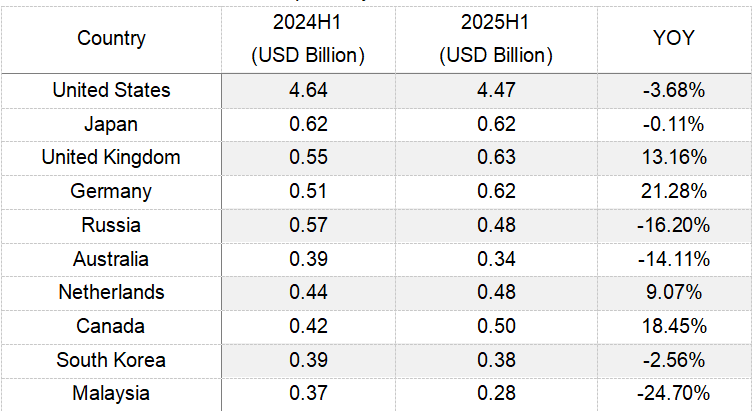

From a market structure perspective, the United States remains China's largest export market, with exports totaling USD 4.465 billion in the first half of the year, accounting for 29.96% of total sporting goods exports. This represents a 3.68% decrease compared to last year, with its market share slightly declining from 31.44%.

Exports to the United Kingdom, Germany, the Netherlands, and Canada saw significant growth, reaching USD 627 million, USD 622 million, USD 477 million, and USD 500 million respectively, with year-on-year increases of 13.16%, 21.28%, 9.07%, and 18.45%.

Exports to Japan and South Korea remained relatively stable, with slight decreases of 0.11% and 2.5% year-on-year. In contrast, exports to Russia, Australia, and Malaysia dropped sharply, among them, exports to Malaysia, Vietnam, and Singapore fell by 24.70%, 9.76%, and 30.13% respectively.

Table 2. Export Value and Growth Rate of Sporting Goods to Various Markets (H1 2025)

Affected by the US tariff hikes implemented at the beginning of the year and the "reciprocal tariff" policy in April, exports to the US shifted from a 9.62% growth in the first quarter to a 15.60% decline in the second quarter. However, the decline was lower than expected, showcasing the strong competitiveness of China's sporting goods. Meanwhile, exports to major Western European markets witnessed significant growth, with the growth rate further accelerating in the second quarter, reflecting that companies are increasing their presence in Europe to hedge against risks in the US market.

Copyright ©2013-2024 CHINA SPORTING GOODS FEDERATION, All Rights Reserved ( 京ICP备05083596号-1 )